Posted by Steve Distante on 5/31/18 10:39 AM

To view the original article, click here.

Is it actually possible to create investments that offer impact while at the same time returning market-rate financial returns? We interviewed Gloria Nelund of TriLinc Global, an investment sponsor with the mission of doing exactly that.

Vanderbilt: What do you see as the #1 reason you’ve been able to perform as well as you’ve been able to, creating market return as well as generating social impact?

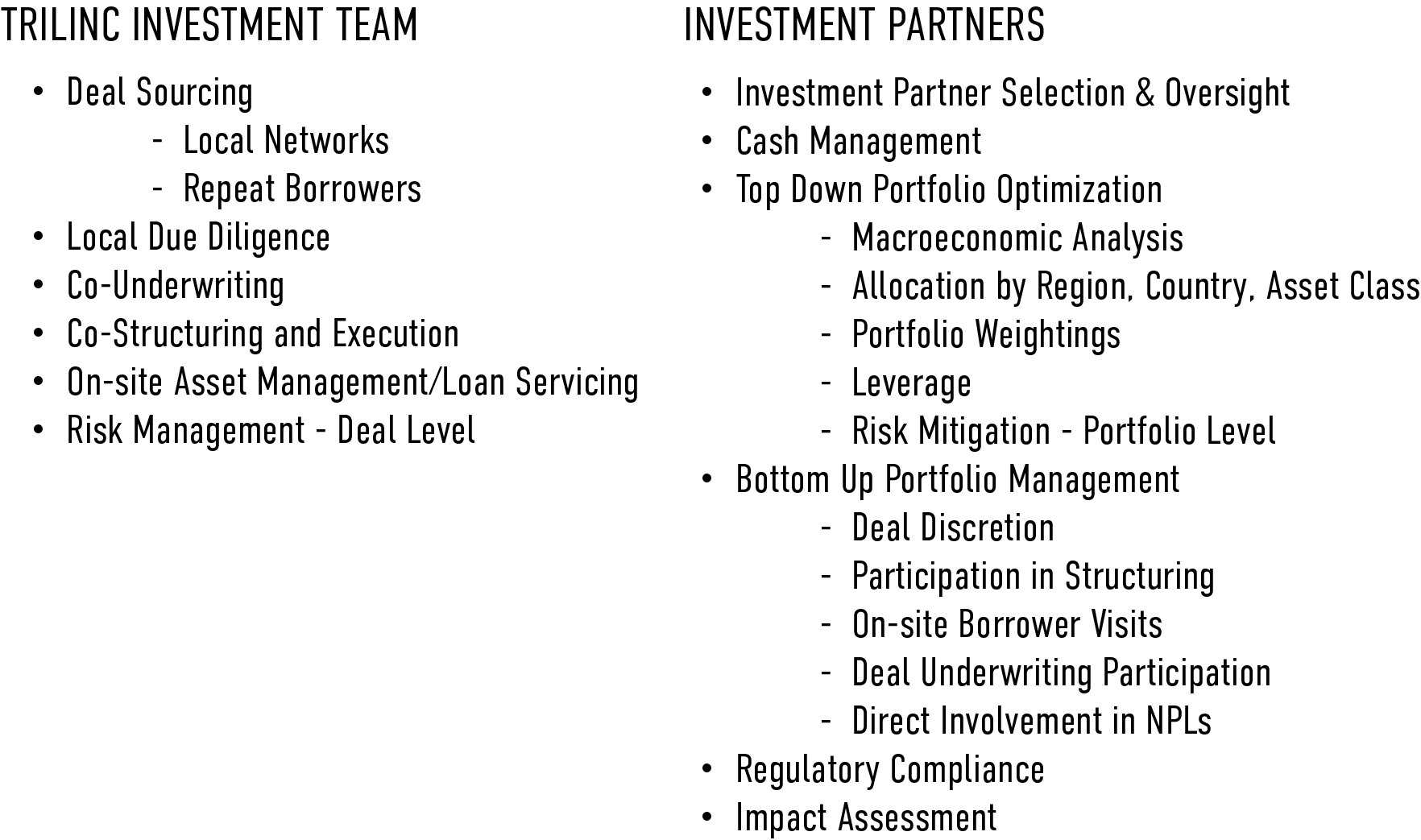

Gloria Nelund: We designed our investment strategy to take advantage of a real investment opportunity that also has the potential to create positive impact, and then we created rigorous processes, not only around our investment analysis but also around our ESG and Impact analysis. What makes us different from other investment firms is that we embedded the ESG and impact tracking into our investment process.

For example, the analysis we do around a company’s ESG policies and practices is gathered in the beginning of our review, at the same time we’re doing our financial analysis of the company. Our impact and sustainability analysts are part of the investment team and sit next to our credit analysts. When we first get an opportunity they’re together doing the analysis, yet they come at it from two different angles. One important thing about this process is that, early on in the deal analysis, we can identify any potential ESG issues that need to be considered before we commit to full due diligence.

We also are a bit unique in that we have impact objectives at both the portfolio level and the individual borrower-company level. Our portfolio level impact objective on our current funds is Economic Development through providing access to capital to underserved SMEs in select developing economies. That objective is tracked on all investments in the portfolio by measuring progress on five key metrics that are known to drive economic development (e.g. job creation). Additionally, intent to create impact is something we look for in our portfolio companies, so, we require each borrower to identify their own impact objective(s) on which they are willing to be measured.

So, you can see that how we look at companies is multidimensional and goes past the traditional sort of pure investment analysis.

Vanderbilt: Do you think that the upcoming generations are truly more open to impact investing than their predecessors or does it seem more of a myth?

Gloria Nelund: Yes, I believe it is real.

I see it in my own kids, my nieces, nephews and their friends, and they’re all looking for investments that create some kind of impact. Right now, because they don’t have a lot of money, they’re looking at SRI and ESG-screened mutual funds, but, their desire to make a difference even shows up in the products they buy, the universities they consider, and the jobs they seek.

I truly believe it’s just a matter of time until we see the younger generations, the Millennials and Generation X, making more impact investments. They’re just not at the stage in life yet where they have the wealth, but as they inherit or create wealth for themselves they will continue to drive demand.

We’re already seeing a catalyst with institutional investors though. They are starting to pay more attention to impact investing because there are now funds that can meet their institutional standards of quality investments with track records and rigorous processes. For example, our firm’s strategy now has a 5 year track record and almost $500MM under management so we are able to attract the institutional investors that we could never have as a startup. It’s happening across the board as more and more fund managers are building the necessary track records and can finally be seen as a viable option for institutional investors.

Vanderbilt: What do you see as the biggest factor working against the progress of impact investing?

Gloria Nelund: There are a few things.

One is the lack of clarity from the industry itself around common definitions, language, and metrics. I would say that, as an industry, we’ve made the biggest strides with ESG because the CFA Institute published an ESG Guide for Investors and have incorporated ESG principles into their CFA testing. That has really helped bring some clarity and emphasis. But in other cases, the vocabulary can be quite varied. For example, we don’t all define “impact investing” the same way and we use different rules and standards for how we track and report. The best illustration of this is “job creation.” To measure growth in jobs, you need to know what defines a “job.” Is it only full time workers, or does it include part time workers, seasonal employees, contractors?

To make sure we are comparing apples to apples, there need to be commonly accepted rules and standards, similar to GAAP, the Generally Accepted Accounting Principles for financial reporting. Just like companies in different industries have different types of financial reports, GAAP ensures that they all use the same definitions and apply common accounting rules the same way. We need similar rules and standards that guide impact tracking and reporting, regardless of a firm’s individual impact framework. For tracking and reporting on impact, our company uses the IRIS metrics, that then roll up to our impact objectives.

Second, education of advisors and investors is an issue. This is just a matter of time and scale; the more people who are aware of impact investing, and the more capacity there is, the quicker the adoption rate.

Third, there are still not enough investible funds that create competitive returns and impact at the same time. Since the majority of investors simply can’t give up investment returns to do good, we need more impact investment options that can deliver market-rate returns. Individual investors have two “buckets;” their investment bucket and their philanthropy bucket. The investment bucket needs to generate their target returns so that they don’t outlive their money (or so they can maintain their lifestyle). That means that anything perceived to have concessionary returns, ends up in the philanthropy bucket, which is a much smaller bucket. So, if we want them to use “investment” capital, we need products that can do both; generate market rate returns from investments in sustainable, responsible companies, AND prove the impact of the investments.

Institutional investors have the same issue, but for different reasons. They all have an investment mandate, or investment policy statement, that says “here is what you have to do.” So, they really can’t make concessionary investments either.

Impact investing, if done properly, can yield products that are scalable, deliver risk-adjusted market rate returns, with disciplined operations and compliance processes, yet at the same time, can generate positive, measurable impact. What Gloria didn’t tell us in the interview is that TriLinc Global is a B Corp, meaning they were required to undergo a rigorous certification process to demonstrate that the firm has great employee practices, great governance, is active in the community, and does appropriate things to support the environment. TriLinc Global is a great example of how we can be smart investors and business owners and do it all in a way that benefits people and planet.

Read more from the Vanderbilt Financial Group blog here.