Finding quality businesses to invest in requires deep local networks, a firm understanding of the culture and regulatory environment, and a local reputation for being a high-quality lending partner.

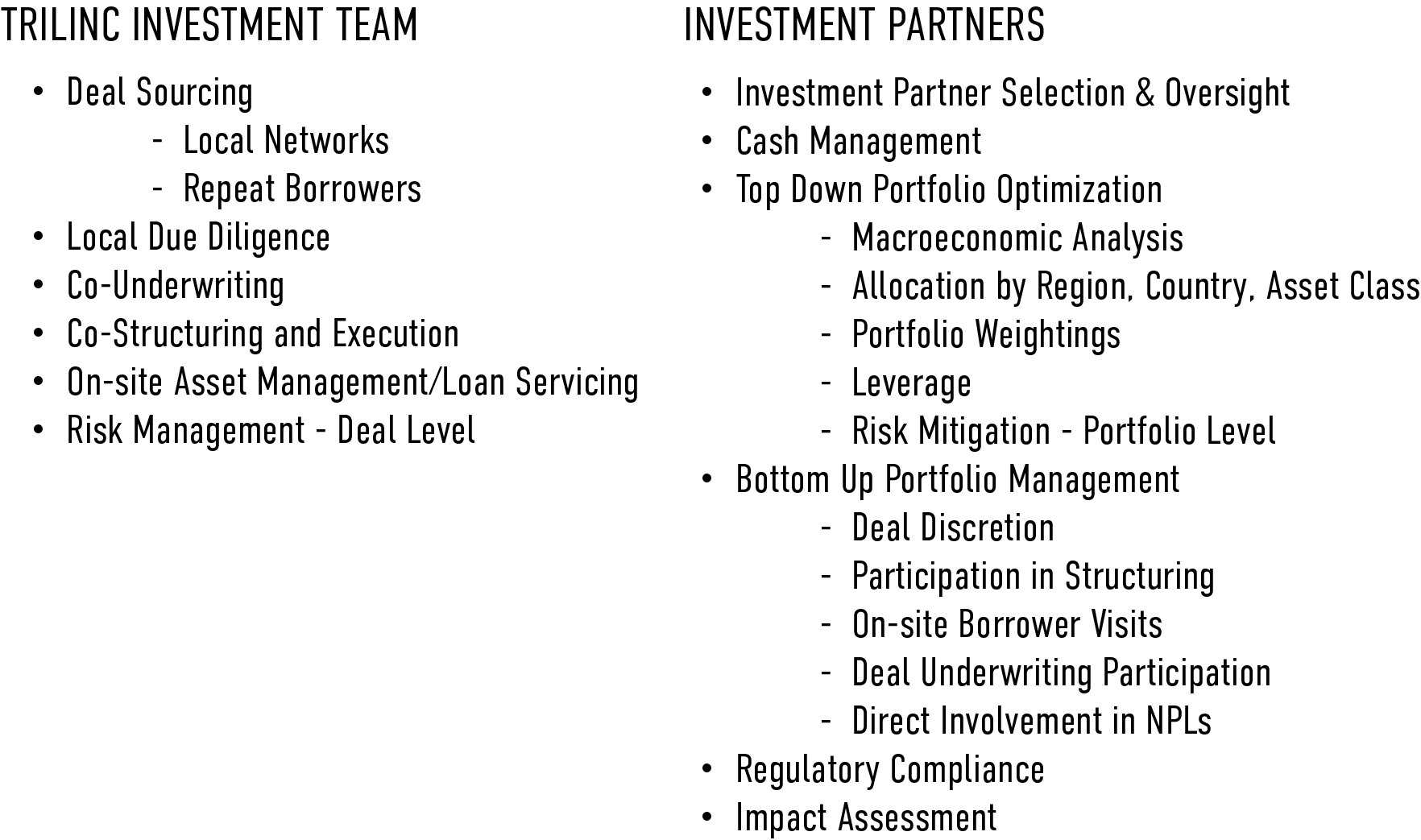

For these reasons, TriLinc has partnered with multiple experienced in-country private debt managers who act as on-the-ground agents, originating loans for TriLinc’s consideration and performing ongoing local investment level oversight. In accordance with our risk management philosophy which emphasizes a comprehensive approach to investing and asset management, our investment partners strategies are primarily tailored to the characteristics of private financing of SMEs in developing economies. In addition to the benefits of dual underwriting and global diversification, unlike a fund-of-funds model, there is a single layer of fees as management and incentive fees which are shared with investment partners.

Benefits of TriLinc’s Unique Partner Model

- Boots on the ground to mitigate idiosyncratic local market risk

- “Double” underwriting to ensure adherence to risk standards and specific client mandates

- Emerging markets exposure without the volatility of public markets

- Comprehensive diversification such that no single macroeconomic factor can significantly affect the portfolio

- Flexibility to quickly adapt to changing local economic conditions

TriLinc’s investment strategy begins with “top-down” global macroeconomic analysis designed to identify countries with strong growth fundamentals, legal and political stability and unrestricted capital access. The “top down” analysis is then complemented by “bottom-up” input from our local investment partners to identify markets with strong potential for financial returns and social and/or environmental impact.

TriLinc has implemented our investment strategy through partnering with multiple investment partners.

Private Debt Plus® Investment Strategy:

- Targeting countries with favorable economic growth and investor protections;

- Partnering with sub-advisors with significant experience in local markets;

- Focusing on creditworthy lending targets who have at least 3-year operating histories and demonstrated cash flows, enabling loan repayment;

- Making primarily debt investments, backed by collateral and borrower guarantees;

- Employing sound due diligence and risk mitigation processes; and

- Monitoring our portfolio on an ongoing basis.

OUR EXPERTISE

Although the shortage of capital available for SMEs is consistent throughout the developing world, the individual economics themselves are unique. Finding quality businesses to invest in requires deep local networks, a firm understanding of the local culture and regulatory environment, and a local reputation for being a high-quality lending partner. For these reasons, we believe the most prudent strategy is to complement top-down, macroeconomic portfolio optimization and management with experienced, local investment partners who have solid track records, and ample access to high-quality potential investments.

Investment partners are selected based upon a comprehensive due diligence process that evaluates their exposure to, skill with, and track record in select asset classes, regions and countries. Click here to read more.