Although the shortage of capital available for SMEs is consistent throughout the developing world, the individual economies themselves are unique. Finding quality businesses to invest in requires deep local networks, a firm understanding of the local culture and regulatory environment, and a local reputation for being a high-quality lending partner.

TriLinc’s unique investment partner model provides what we believe is lower risk access to these private investment opportunities in select high-growth economies. TriLinc’s investment partners act as on-the-ground agents, originating loans for consideration, and sharing in fee arrangements.

1. Boots on the ground to help mitigate idiosyncratic local risk

2. Dual underwriting and structuring

3. Comprehensive, global diversification

Investment Partner Qualifications

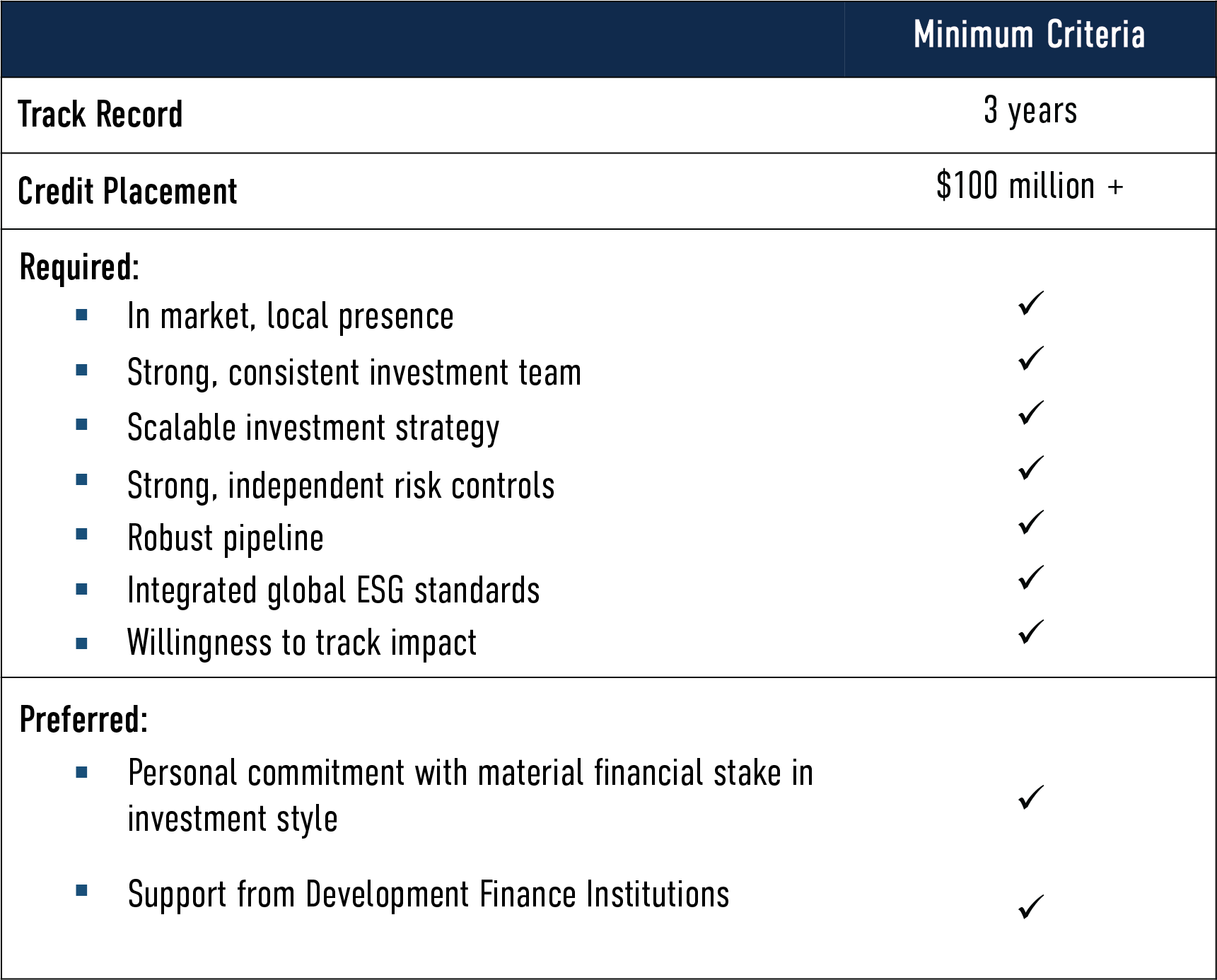

Investment partners must have a minimum three year investment track record and have invested at least $100 million in their target region. They must demonstrate strong, independent risk controls and be willing to screen ESG practices and policies and track on impact progress. Further, investment partner candidates must have continuity in their investment team, including senior management, and an investment strategy that can identify deal pipeline of financially attractive, sustainable, responsible borrower companies.

Finding quality businesses to invest in requires deep local networks, a firm understanding of the local culture and regulatory environment, and a local reputation for being a high-quality lending partner. For these reasons, TriLinc complements top-down, macroeconomic portfolio optimization and management with experienced, local sub-advisors who have solid track records and access to high-quality potential investments. Investment partners are selected based upon a comprehensive due diligence process that evaluates their exposure to, skill with, and track record in select asset classes, regions and countries.

Global Partners

Investment partners are selected based upon a comprehensive due diligence process and based upon their exposure to, skill with, and track record in selected asset classes, regions and countries. In order to qualify for investment partner status, interested firms must invest in our target asset classes with a local presence in our desired regions and/or countries.

1. Initial Interview / Screen

2. Phase I Due Diligence

3. Phase II Due Diligence, including on-site visit

4. Recommendation to Investment Committee

5. Final Approval

1. Initial Interview / Screen

Once potential partners have been identified, a member of TriLinc’s investment team conducts a phone interview reviewing the manager’s investment strategy, team and history, and specific data to determine whether the manager meets the criteria to identify quality pipeline in TriLinc’s targeted countries. Specific data collected includes: regional and asset class focus, assets placed to-date, management tenure, performance track record, investment characteristics, and deal pipeline.

2. Phase I Due Diligence

Phase I Due Diligence gathers detailed information on the manager, including its organization, people, investment strategy and process, and relevant track record and is used to determine if a manager should move on to Phase II Due Diligence.

3. Phase II Due Diligence

Phase II Due Diligence includes additional detailed information about the firm and its people but also includes a multi-day, on-site visit to the manager’s primary location by at least two members of TriLinc’s investment team and either TriLinc’s CIO or TriLinc’s CEO. The site visit is used to determine cultural fit and to inspect back office controls, review credit files to ensure processes are consistently followed, and to review the strength of both investment and back office functions.

4. Recommendation to the Investment Committee

Once all due diligence has been completed satisfactorily, the investment team recommends the manager to the CIO who then submits a full analysis and formal approval recommendation to the TriLinc Investment Committee.

5. Final Approval

Unanimous approval by the TriLinc Investment Committee is required before entering in to an investment partner agreement. TriLinc’s investment partner agreement is intentionally structured to ensure that the investment partner’s interests are closely aligned with the interests of our fund investors.

Our Investment Partners

TriLinc’s investment partners act as on-the-ground agents, originating loans for consideration, and sharing in fee arrangements. Our investment partner management teams provide ongoing monthly portfolio, pipeline and market level calls; detailed quarterly “bottom up” position level reviews; participation in investment partner investment committee or more stringent oversight processes; a detailed investment request process for each investment and an annual onsite investment partner visits.

BROWSE OUR INVESTMENT PARTNERS >