SME Investment Opportunity

We seek to make investments in private, small-to-medium enterprises (“SMEs”)1 that have a proven business model, stable management, and opportunity for growth operating in regions without adequate access to investment capital.

TriLinc believes that SMEs are both the foundation and the building blocks for sustained economic development as they:

• Create jobs

• Provide stable and growing incomes

• Pay taxes to local government institutions through increased revenue and profit

• Drive local production of quality goods and services

• Propel growth of the middle class in their communities

Even in developed economies, like the U.S., these businesses are often considered the lifeblood of the economy. In the U.S., they represent 99.7 percent of employer firms, created over 64 percent of net new private-sector jobs in the past decade, account for nearly half of nonfarm private GDP, and account for a significant portion of innovation.2,3

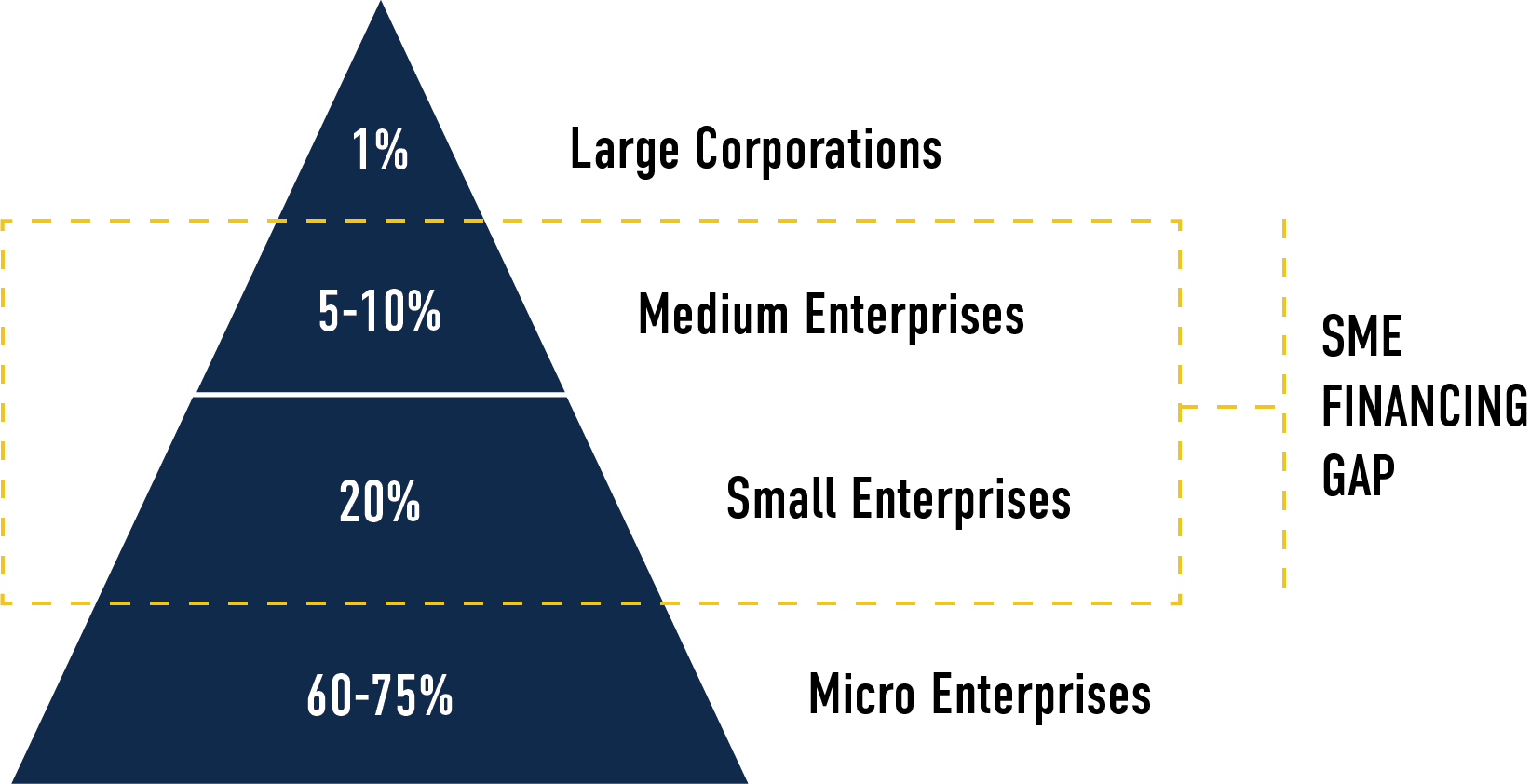

SME Finance is often characterized as the “Missing Middle,” which typically refers to businesses that are too large to be served by microfinance institutions but too small to access sufficient local commercial bank financing. According to the World bank and IFC, the gap between demand and supply of SME credit is estimated to be as much as $4.5 trillion in emerging markets. Historically, a lack of investment capital and poor economic policies have generally suppressed the growth of these SMEs who, just like U.S. business owners, are willing to work hard to expand their businesses, create real value for their communities, accept accountability for results, and ultimately help contribute toward a better future for their families and communities. Unfortunately, the most common obstacle hindering their growth is lack of access to financing to grow their business.

The International Finance Corporation has estimated that unmet demand for SME financing in developing economies is as much as $4.5 trillion.4

Our Focus

TriLinc believes that the underserved nature of such a large segment of the global economy, coupled with strong demand for capital from the SMEs themselves, has created significant opportunity for attractive investment terms in the form of current cash yield, deferred interest and equity warrants and more attractive security features in the form of loan covenants and quality collateral. Additionally, compared to larger companies, SMEs typically have more simple capital structures and carry less overall debt, which aids in the structuring and negotiation process, ultimately allowing for greater flexibility in structuring mutually favorable transactions.

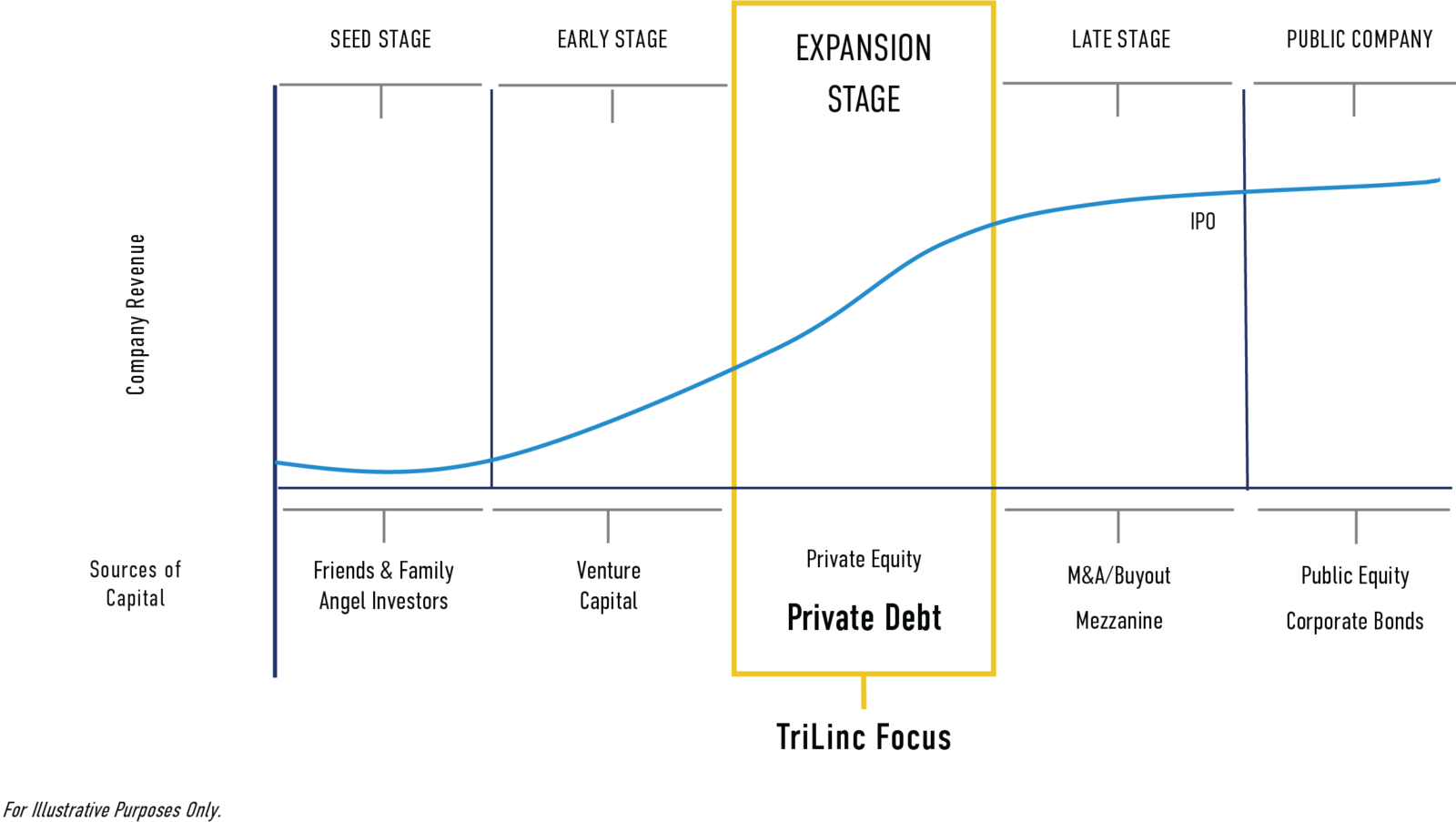

TriLinc targets expansion stage companies in need of capital to expand operations, improve the financial standing of their operations, or finance the trade of their goods with other markets. We generally do not target new or start-up businesses, but rather those which have been operating for at least three years with proven profitability, strong cash flow, stable revenues, unencumbered collateral assets, with strong ESG policies and practices and a commitment to creating positive, measurable impact.

For investors, TriLinc’s debt financing helps provide capital access to growing businesses at a safer place in the capital structure relative to equity, with a built-in exit through the repayment of principal. At the same time, debt financing also provides benefits to the local business owners through allowing them to maintain control of their business and ultimately, retain the equity from the company’s growth.

< Investment Partner Selection

1TriLinc adopted the common definition of SME, used by the U.S. Small Business Association, which are those companies having fewer than 500 employees (with sector-specific exceptions). 2https://www.sba.gov/sites/default/files/FAQ_Sept_2012.pdf 3https://www.sba.gov/content/small-business-gdp-update-2002-2010 4MSME FINANCE GAP: Assessment of the Shortfalls and Opportunities in Financing Micro, Small and Medium Enterprises in Emerging Markets – World Bank Group, SME Finance Forum and International Finance Corporation 2017