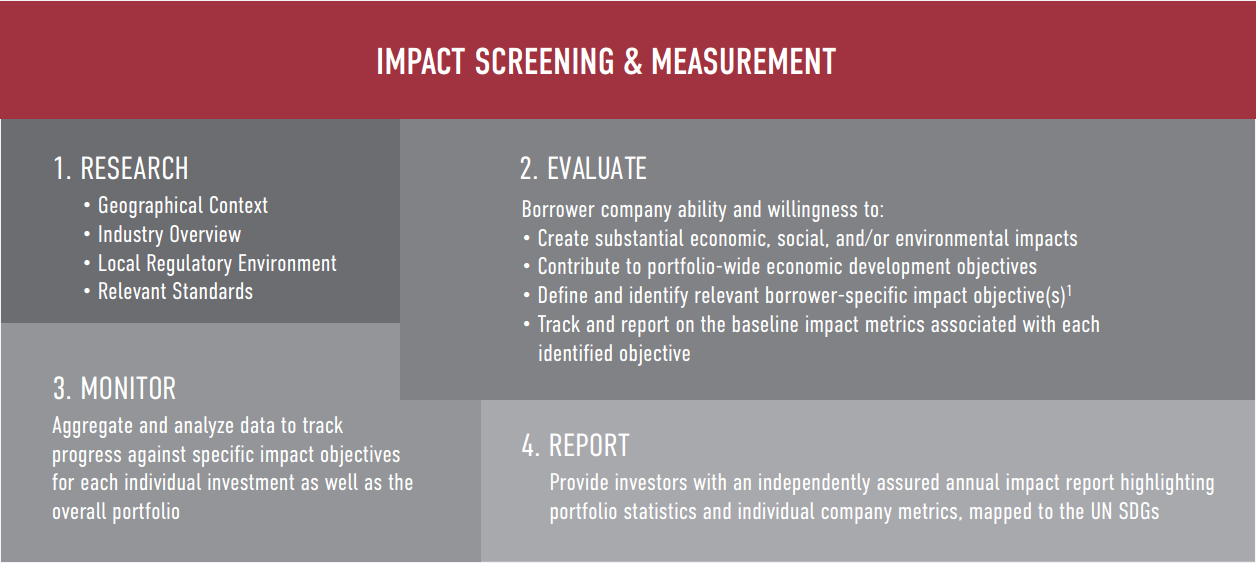

TriLinc’s ESG and impact assessment and evaluation methodologies are fully integrated into our investment and portfolio management processes and procedures.

Impact Tracking and Reporting

Each of TriLinc’s funds have an overall impact objective of economic development through providing access to finance to under-served, growth-stage SMEs operating in select developing economies. TriLinc measures each fund’s contribution to economic development through the collection, tracking, and reporting of five core metrics which are aggregated across the fund’s portfolio.

- Job creation

- Wage growth

- Increased revenues

- Increased net profits

- Increased taxes paid to local governments

By creating jobs, providing steady and growing incomes, and often providing training and other employee benefits, borrower companies help workers in their local communities to generate income, build assets, and sustain livelihoods, thus fostering a stable middle class. By paying taxes to local government institutions based on increased revenue and net profits, borrower companies contribute significantly to the development of vibrant communities with the potential to improve local infrastructure, education, and healthcare systems, among others.

Further, TriLinc believes it is important for borrower companies to be aligned with TriLinc’s mission to create positive, measurable impact and therefore, TriLinc collects, tracks, and reports on impact data that demonstrate the borrower company’s intent to create positive economic, social, and/or environmental impact through one or more self-selected impact objective that best represents the company business activities and operational goals in their respective sectorial and geographical contexts.

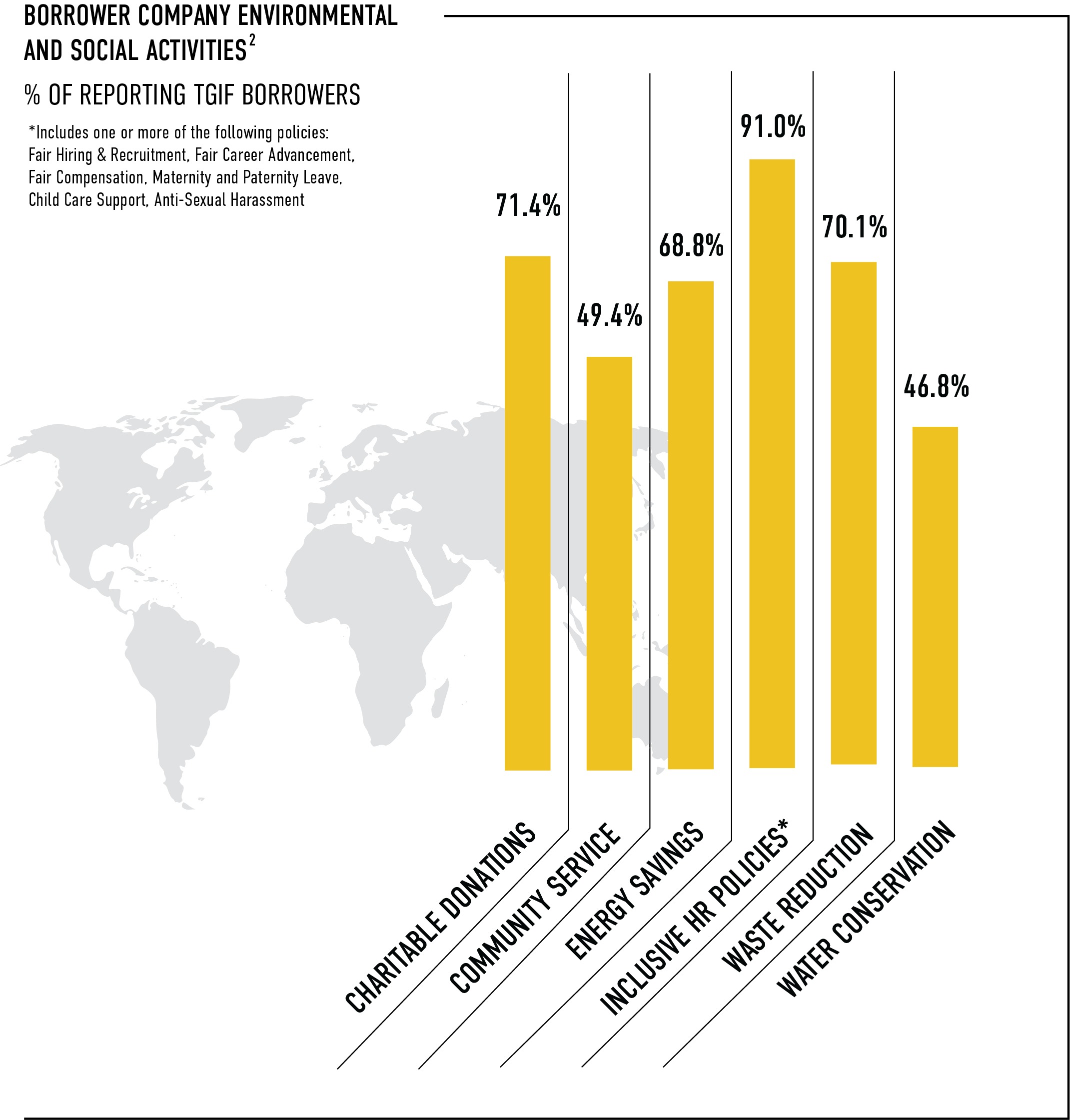

In addition to collecting, tracking, and reporting on the borrower-selected impact objectives, TriLinc gathers information on the strategies and practices each borrower employs to reduce its environmental footprint, further local community development, and foster employee equality and empowerment.

Results from pre-investment ESG and impact assessments, and subsequent and post-investment monitoring, are reported through various media, including borrower-company specific investment and impact summaries, monthly portfolio and impact updates, and sustainability and impact reports. TriLinc assesses the portfolio-wide and borrower-specific results of TriLinc’s ESG and impact screening and measurement programs throughout each fund’s life cycle and incorporates findings into TriLinc’s strategic decision-making processes.

TriLinc Sustainability and Impact Reports can be found here.

1Borrower-specific impact objectives are selected by each borrower company and include, but are not limited to: job creation, capacity-building, agricultural productivity, food security, health improvement, community development, and energy conservation. 2Data from the 2022 TGIF Sustainability and Impact Report.