Click to view the 2018 TGIF Sustainability & Impact Report.

Author: trilinc_admin17

Weekly Impact Investment Market Update: February 22, 2019

Impact Investing & ESG

Impact Investing Gains Traction in Canada

The 2018 Canadian Impact Investment Trends Report says total assets under management (AUM) in impact investments — companies, organizations, or funds that aim to create a positive social or environmental impact in addition to a financial return — rose to $14.75 billion as of Dec. 31, 2017, from $8.15 billion at Dec. 31, 2015.

How Socially Conscious Young Investors are Putting Their Money Where Their Ideals Are

An influx of young investors are leading a charge of socially responsible and sustainable investing, experts say, funneling their money into investments and projects that serve the greater good.

Most Managers See Sustainable Investing as Essential to Thrive – Survey

Most U.S. money managers view sustainable investing as a strategic business imperative and have adopted such investment practices, said results of a new survey from the Morgan Stanley (MS) Institute for Sustainable Investing and Bloomberg.

‘Increasing Maturity’: PwC Highlights Growth of ESG and Sustainable Investing

Global survey of 145 private equity houses finds environmental, climate and sustainability issues increasingly key for investors

Behind the Numbers: Retail Investors a Growing Force of Sustainable Funds

Ethical funds have been growing in popularity, with managers starting to address the demand. Once a niche area, sustainable investing has become one of the hottest topics in the investment world.

High Net Worths Believe in ESG but yet to Proactively Invest

Around 76% of UK high net worth individuals (HNWIs) believe the idea of environmental, social and governance investing is important, according to research.

Pushing the Boundaries to Make Impact Investing Available to Everyone

One of the challenges of impact investing is the perception that there is a lack of opportunities. This is happening across investors, financial advisors and even pension fund managers.

ESG Investing Does Not Cost More, Research Shows

Pension funds performing well on environmental, social and corporate governance (ESG) factors don’t incur higher asset management costs, according to research.

Developing Economies

What to Expect from Sub-Saharan Africa Economy in 2019

The IMF economic outlook presents a picture of what to expect from each economy or region annually. For Sub-Saharan Africa (SSA) in 2019, a GDP growth rate of 3.4% is projected at the aggregate level; a slight improvement over the 2.9% actual growth rate of 2018.

Ghana Meets Most IMF Targets as Reforms Advance, Says Lender

Ghana met most of the targets under its program with the International Monetary Fund and is continuing to advance reforms that will promote economic stability, according to the lender.

Zambia, Botswana, Sign AfCFTA

Zambia and Botswana have signed the agreement of the African Continental Free Trade Area (AfCFTA) mean to create one African market. The two countries signed the agreement at the just-ended African Union Summit.

Politics Loom Over Thai Economy as Election Stirs Tension

Political tension has emerged as a threat to the domestic economic drivers Thailand is relying on amid a global slowdown. A push to disband a political party over a failed bid to make a princess its prime ministerial candidate lays bare deep splits ahead of a March general election, the first since a coup in 2014.

Vietnam’s Booming Economy Offers Investment Opportunities

Vietnam’s economy is growing and Asian fund managers are bullish on the country’s prospects. We assess the opportunities and how you can gain access.

TriLinc Global Launches New Fund

February 06, 2019 10:15 AM Pacific Standard Time

MANHATTAN BEACH, Calif.–(BUSINESS WIRE)–TriLinc Global, LLC announced today its Regulation D offering of the TriLinc Global Impact Fund II, LLC. “We are very pleased to continue to offer investors with what we believe to be lower risk access to private investment opportunities available in select-high growth economies including Latin America, Southeast Asia, Sub-Saharan Africa, and Emerging Europe,” commented Gloria Nelund, CEO of TriLinc Global, LLC. The TriLinc Global Impact Fund II, LLC (“TGIF II”) is a developing economy private debt fund focused on making private loans to private growth stage companies that are committed to responsible, sustainable management and to the creation of positive, measurable impact in their communities. “We believe this shortage of capital helps create meaningful opportunity to generate competitive risk-adjusted returns and positive impact,” stated Ms. Nelund.

About TriLinc Global, LLC

TriLinc Global (www.trilincglobal.com)

TriLinc is an impact investing fund sponsor with a mission to link market-rate returns, positive impact, and scalable solutions. Through its registered investment advisor subsidiaries, TriLinc has invested over $1 billion in private debt globally and seeks to demonstrate the power of the capital markets in helping solve some of the world’s pressing socioeconomic and environmental challenges. TriLinc funds provide growth-stage loans and trade finance to established small and medium enterprises (“SMEs”) in select developing economies where access to affordable capital is limited. Borrower companies must demonstrate the ability to pay market rates, pass TriLinc’s environmental, social, and governance (ESG) screens, and commit to tracking and reporting on self-identified impact metrics. To learn more about TriLinc Global please visit the TriLinc Global website at www.trilincglobal.com.

DISCLAIMER

This information is for general purposes only and does not represent a recommendation or offer of any particular security, strategy, or investment. Amount invested represents current amount financed in term loans, trade finance, and short-term notes since 2013. There is no guarantee that TriLinc’s investment strategy will be successful or will avoid losses. Investment in a pooled investment vehicle involves significant risk including but not limited to: units are restricted; no secondary markets; limitation on liquidity; transfer and redemption of units’ distribution made may not come from income and if so will reduce the returns; are not guaranteed and are subject to board discretion. TriLinc is dependent upon its advisors and investment partners to select investments and conduct operations. TriLinc is not suitable for all investors. TriLinc Global LLC (“TLG”) is a holding company and an impact fund sponsor founded in 2008. TriLinc Advisors, LLC (“TLA”) is a majority-owned subsidiary of TLG and TriLinc Global Advisors LLC. (“TLGA”) is a wholly-owned subsidiary of TLG. TLA and TLGA are SEC registered investment advisors. Securities offered through Frontier Securities LLC, Member FINRA/SIPC. Registration and memberships do not indicate a certain level of skill, training or endorsement by the SEC, FINRA or SIPC.

Contacts

Robert Kronman – Director of Marketing

rkronman@trilincglobal.com

(o) 424 200 6202

(c) 310 497 2116

Market Volatility Webinar Replay

On February 28, 2019, Gloria Nelund, Founder and CEO of TriLinc Global, and Paul Sanford, Chief Investment Officer, hosted an educational webinar – Market Volatility.

The webinar covered topics including:

- Is market volatility here to stay?

- The opportunity for alpha

- Circumventing volatility with private assets

Click here to download a copy of the webinar deck.

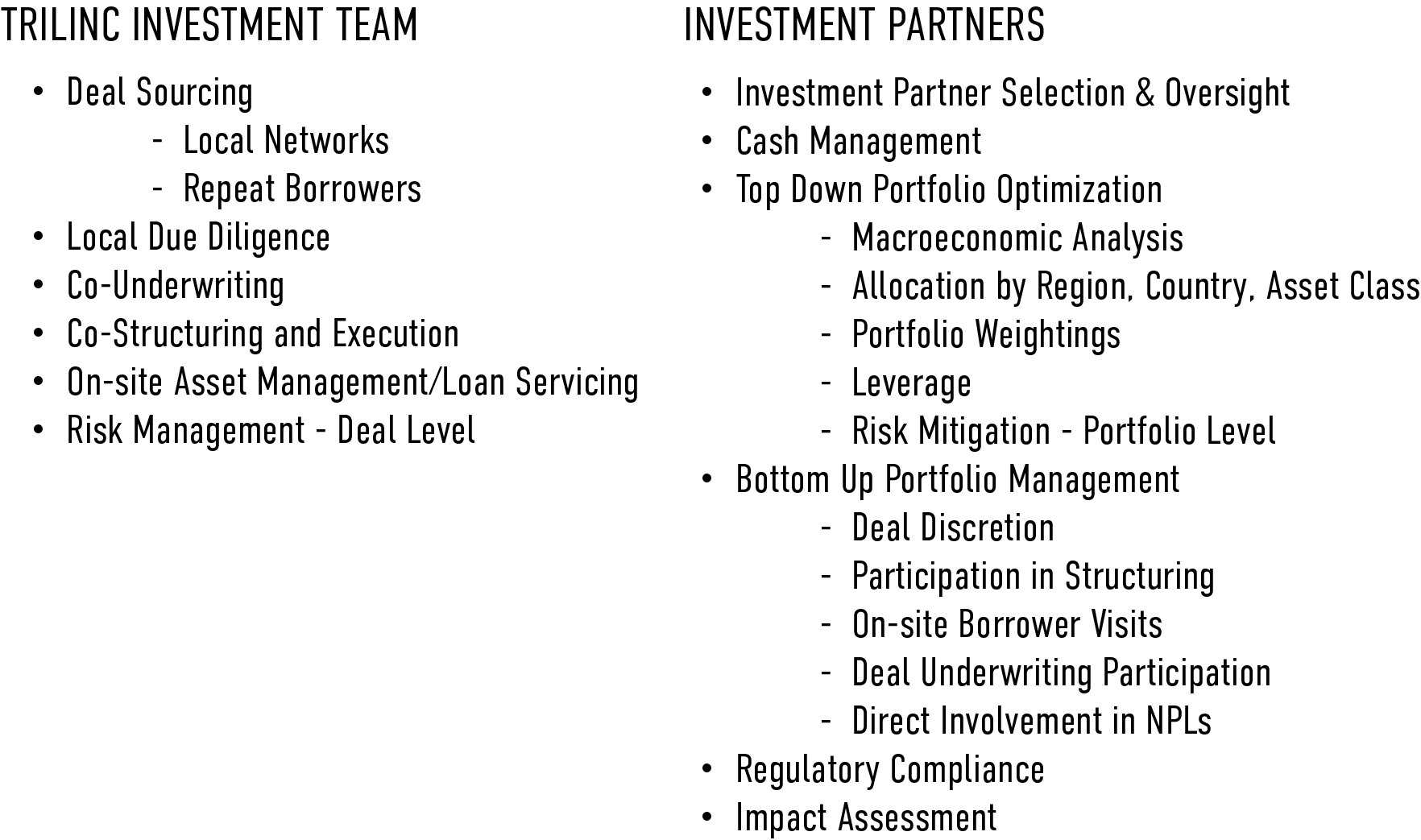

Unique Business Model

Finding quality businesses to invest in requires deep local networks, a firm understanding of the culture and regulatory environment, and a local reputation for being a high-quality lending partner.

For these reasons, TriLinc has partnered with multiple experienced in-country private debt managers who act as on-the-ground agents, originating loans for TriLinc’s consideration and performing ongoing local investment level oversight. In accordance with our risk management philosophy which emphasizes a comprehensive approach to investing and asset management, our investment partners strategies are primarily tailored to the characteristics of private financing of SMEs in developing economies. In addition to the benefits of dual underwriting and global diversification, unlike a fund-of-funds model, there is a single layer of fees as management and incentive fees which are shared with investment partners.

Benefits of TriLinc’s Unique Partner Model

- Boots on the ground to mitigate idiosyncratic local market risk

- “Double” underwriting to ensure adherence to risk standards and specific client mandates

- Emerging markets exposure without the volatility of public markets

- Comprehensive diversification such that no single macroeconomic factor can significantly affect the portfolio

- Flexibility to quickly adapt to changing local economic conditions

TriLinc’s investment strategy begins with “top-down” global macroeconomic analysis designed to identify countries with strong growth fundamentals, legal and political stability and unrestricted capital access. The “top down” analysis is then complemented by “bottom-up” input from our local investment partners to identify markets with strong potential for financial returns and social and/or environmental impact.

TriLinc has implemented our investment strategy through partnering with multiple investment partners.

Private Debt Plus® Investment Strategy:

- Targeting countries with favorable economic growth and investor protections;

- Partnering with sub-advisors with significant experience in local markets;

- Focusing on creditworthy lending targets who have at least 3-year operating histories and demonstrated cash flows, enabling loan repayment;

- Making primarily debt investments, backed by collateral and borrower guarantees;

- Employing sound due diligence and risk mitigation processes; and

- Monitoring our portfolio on an ongoing basis.

OUR EXPERTISE

Although the shortage of capital available for SMEs is consistent throughout the developing world, the individual economics themselves are unique. Finding quality businesses to invest in requires deep local networks, a firm understanding of the local culture and regulatory environment, and a local reputation for being a high-quality lending partner. For these reasons, we believe the most prudent strategy is to complement top-down, macroeconomic portfolio optimization and management with experienced, local investment partners who have solid track records, and ample access to high-quality potential investments.

Investment partners are selected based upon a comprehensive due diligence process that evaluates their exposure to, skill with, and track record in select asset classes, regions and countries. Click here to read more.

TGSIF Fund Closing Notice

On December 31, 2018, the TriLinc Global Sustainable Income Fund (“TGSIF”) closed the offering period to investors.

TriLinc plans to launch new funds in Q1 2019 in order to continue to provide investors with what we believe to be lower risk access to private investment opportunities available in select high-growth economies including Latin America, Southeast Asia, Sub-Saharan Africa, and Emerging Europe.

TriLinc’s private debt investment strategy (Private Debt Plus®) aims to deliver market-rate returns through private loans to private Small and Medium-sized Enterprises (SMEs) in select developing countries plus positive impact that is measurable and reportable utilizing the Global Impact Investing Network (GIIN) Impact Reporting and Investment Standards (IRIS).

For additional information, please contact info@trilincglobal.com

DISCLAIMER

This information is for general purposes only and does not represent a recommendation or offer of any particular security, strategy, or investment. There is no guarantee that TriLinc’s investment strategy will be successful or will avoid losses. Investment in a pooled investment vehicle involves significant risk including but not limited to: units are restricted; no secondary markets; limitation on liquidity; transfer and redemption of units’ distribution made may not come from income and if so will reduce the returns; are not guaranteed and are subject to board discretion. TriLinc is dependent upon its advisors and investment partners to select investments and conduct operations. TriLinc is not suitable for all investors. TriLinc Global LLC (“TLG”) is a holding company and an impact fund sponsor founded in 2008. TriLinc Advisors, LLC (“TLA”) is a majority-owned subsidiary of TLG and TriLinc Global Advisors LLC. (“TLGA”) is a wholly-owned subsidiary of TLG. TLG and TLGA are SEC registered investment advisors. Securities offered through Frontier Securities LLC, Member FINRA/SIPC. Registration and memberships do not indicate a certain level of skill, training or endorsement by the SEC, FINRA or SIPC.

Balancing Liquidity and Return Objectives Webinar Replay

On January 22, 2019, Gloria Nelund, Founder and CEO of TriLinc Global, and Paul Sanford, Chief Investment Officer, hosted an educational webinar – Balancing Liquidity and Return Objectives.

The webinar covered several topics, including:

- What is Liquidity?

- Liquidity and Returns

- The Endowment Model and Liquidity

- Rethinking Allocations

Click here to download a copy of the webinar deck.

Your Money’s Voice: Women & Investing Webinar Replay

On August 22nd, 2018 Gloria Nelund, Founder and CEO of TriLinc Global, and Sonya Dreizler, Founder of Solutions with Sonya, hosted an educational webinar – Your Money’s Voice – Women & Investing in 2018.

The webinar covered topics including:

- How women are leading the way in impact investing

- How to attract women investors

- The tremendous growth of women as leaders in the workforce and in the boardroom

- The importance of building a portfolio that incorporates your clients’ values

- The opportunity in impact investing with women investors

Click here to download a copy of the webinar deck.

Developing Economies – A Significant Opportunity for Investment

Annual consumption in emerging markets is estimated to reach $30 trillion by 20251, representing what we believe to be the largest growth opportunity in the history of capitalism.

Developing economies have seen strong GDP growth over the last several decades fueled mostly by Small and Medium-Sized Enterprises (SME’s). Formal SME’s contribute up to 60% of total employment, and up to 40% of national income (GDP) in emerging economies1.

The World Bank estimates 600 million jobs will be needed in the next 15 years to absorb the growing global workforce, and in emerging markets, most formal jobs are generated by SMEs which create 4 out of 5 new positions.2 These SMEs, however, are underserved by the financial markets. The International Finance Corporation has estimated the unmet demand for SME financing in developing economies to be as much as $1.1 trillion dollars.3

The Opportunity with TriLinc

- Track record of earning market rate returns

- Positive Social and Economic Impact with Investments

- Target select high-growth economies

TriLinc provides investors with what we believe to be lower risk access to private investment opportunities available in select high-growth economies. At present, we operate in four global regions: Latin America, Southeast Asia, Sub-Saharan Africa, and Emerging Europe. TriLinc only operates in countries with a stable political climate, reliable legal systems and growing economies. To view our Global Impact in these regions, click here.

How We Do It

TriLinc provides term loans and trade financing to private, expansion stage middle market enterprises in carefully selected developing economies where access to affordable capital is significantly limited. Since 2013 TriLinc has:

- Invested over $1 billion in 36 countries4

- Sustained zero default losses5

- A five year track record

- Provided investors with a fairly consistent yield, stable value and low correlation to public markets

If you are interested in learning more, please contact us.

1McKinsey & Company, Winning the $30 Trillion Decathlon, 2012 2The World Bank: Small and Medium Enterprises Finance, 2018 3Closing the Credit Gap for Formal and Informal MSME’s, International Finance Corporation, 2013, Washington DC, IFC 4Transactions, economies and financed amounts as of 11/30/18. These investments occurred in more than one investment vehicle, not of all which may be open for investment. 5To date, TriLinc has not realized any loan losses, however the value of some loans have been marked down from their original loan amount and in such cases may no longer be accruing interest.

Joan Trant, Managing Partner at TriLinc Global – The State of ESG & Impact Investing

Managing Partner Joan Trant discusses the new paradigm of incorporating ESG and impact investing as a risk mitigation portfolio strategy.

This interview was conducted at the Total Impact Philadelphia conference in April 2018. To learn more, visit their website at http://totalimpactconference.com/.

Read more about Joan’s participation in this conference here.