A well-known principle of investing is that diversification helps mitigate portfolio risk.

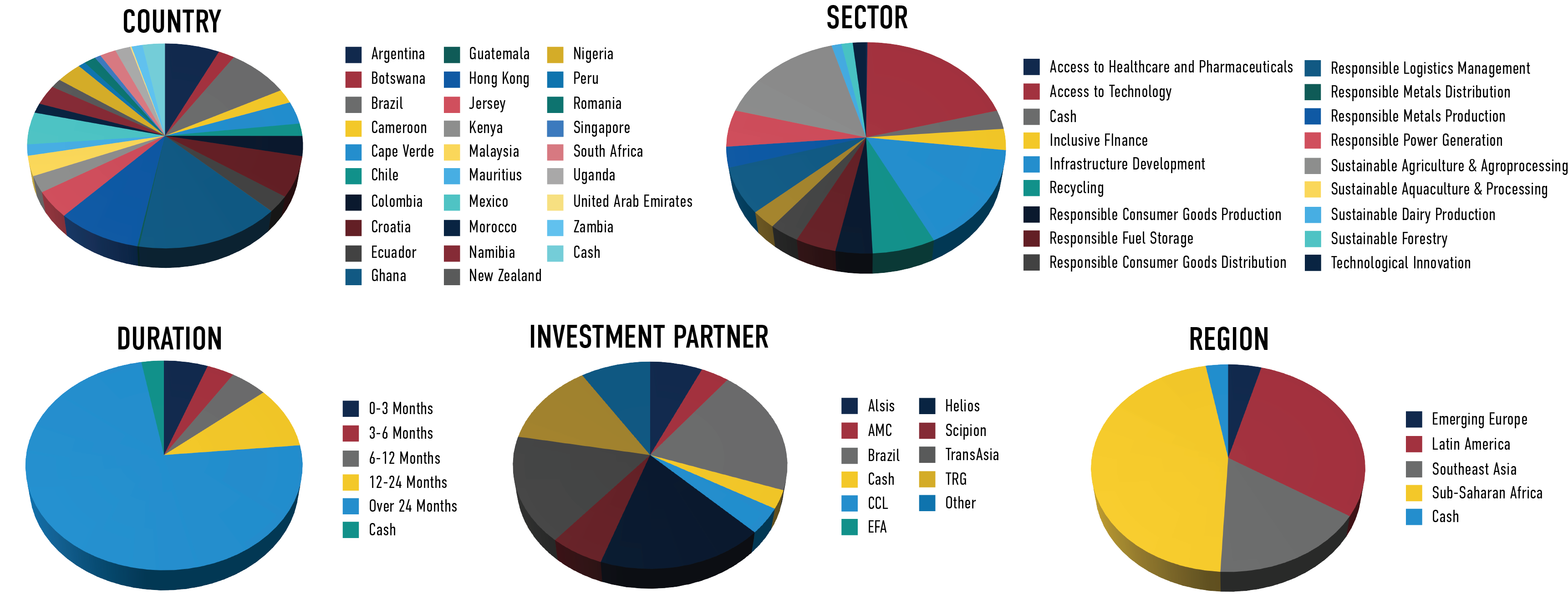

TriLinc seeks to reduce portfolio risk through comprehensive diversification, a signature approach that emphasizes minimizing exposure to any single macro-risk factor. Portfolios are intentionally diversified across:

- Region

- Country

- Asset type

- Sector/industry

- Duration

- Transaction size

- Borrower

- Investment partner

PRIVATE DEBT PLUS® DIVERSIFICATION

TriLinc seeks to reduce portfolio risk through comprehensive diversification, a signature approach that emphasizes minimizing exposure to any single macro-risk factor.

All TriLinc funds have pre-established portfolio concentration limits which can be found in fund-specific material.

The diversification shown is for illustrative purposes only and there is no guarantee that the portfolio will be diversified as illustrated. The diversification was calculated based on strategy loan balance as of 12/31/18.