Borrower Overview

TriLinc has provided financing to an international tuna exporter located on the coast of Ecuador. In addition to helping the company purchase, process and package frozen tuna for export to customers around the world, the company expects that financing from TriLinc will allow it to create more jobs and expand its number of employees, almost half of whom are women. As stated in its Sustainability Report, the company is committed to providing quality jobs, employee training and increasing employer-provided benefits, such as healthcare and performance incentives. The company also requires that its suppliers engage in best practices in product quality and treatment of the environment. The company has been in business since 1999 and a client of a TriLinc sub-advisor since 2005. TriLinc’s due diligence and underwriting has uncovered strong revenue growth and profitability in recent years. Inventory and accounts receivable from international buyers provide collateral underlying the facility and frequent inventory reports are issued by a major independent collateral manager.

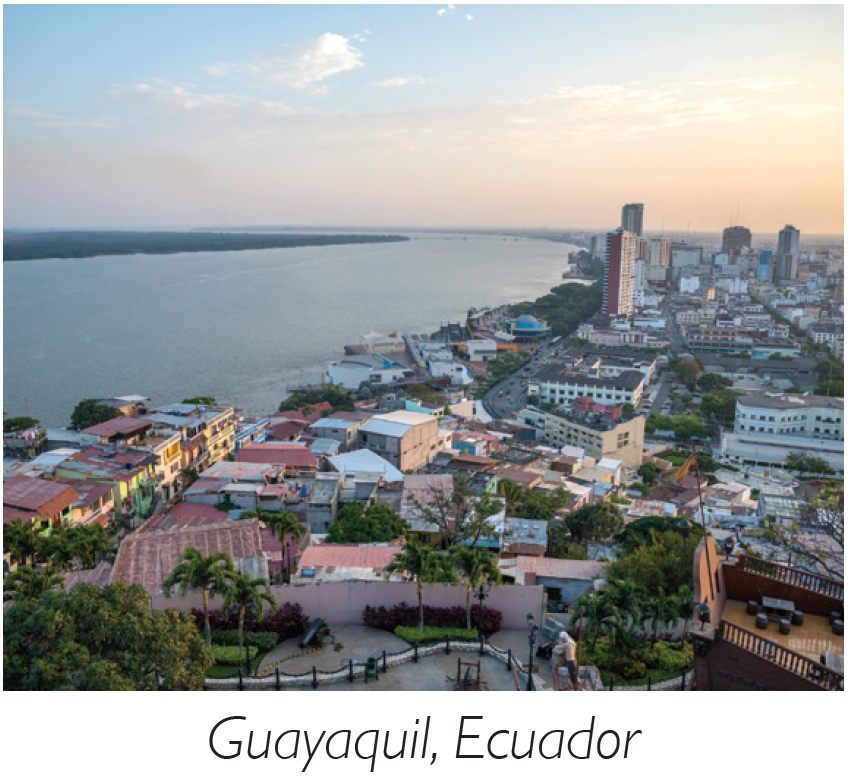

Market Overview

Ecuador is the eighth largest economy in Latin America and is classified as a middle income country by the World Bank.1 Real GDP growth over the last 5 years (2008-2012) has averaged more than 4.5%.1 Since 2000 (2000-2012), real GDP growth has averaged nearly 4.3%.1 Major export sectors include bananas, shrimp, fish, petroleum, cacao, coffee, and wood.

Ecuador meets TriLinc’s country standards for its performance across relevant growth, stability and access metrics.2 In particular, Ecuador scores particularly well versus its regional peers on a series of growth indicators, with what we believe are low levels of public debt and moderate inflation in addition to strong historical growth.

Additional Sustainability & Impact Highlights

- As communicated in its Sustainability Report, the borrower provides quality jobs to its employees with benefits such as health-care, meals, insurance and performance bonuses and takes a holistic approach in caring for its employees by offering access to training, counseling and motivational speakers.

- Suppliers of the borrower are screened annually for their ethical and legal behavior.

- The borrower has implemented environmentally sustainable practices, such as reducing energy, water and fuel consumption and increasing waste management and recycling.

1The collateral coverage ratio is the amount of collateral the borrower must maintain in relation to the total amount outstanding on the facility. 2World Bank, World Development Indicators Databank, June 2013 3There is no assurance that our investment in this company or this market will be successful or that it will have the desired impact.

The above information is as of the initial date of investment: July 17, 2013.

This borrower is no longer a TriLinc fund investment.

TriLinc originally performed an SDG mapping exercise in December 2017 to map all of our borrower companies, both current and exited from our portfolios, to specific SDGs based off of business activity. TriLinc’s official SDG alignment methodology was not finalized until June 30, 2018. For borrowers that had exited TriLinc’s portfolios prior to this time period, the selected SDGs for these borrower are a reflection of what TriLinc believes would have been the SDG alignment if 1) the SDGs had been in effect and 2) TriLinc had integrated the SDG alignment while the company was in the portfolio. The SDG mapping presented does not include input from Investment Partners or borrower companies given that the companies were no longer in the portfolio when the alignment was finalized.

An investment with TriLinc carries significant fees and charges that will have an impact on investment returns. Information regarding the terms of the investment is available by contacting TriLinc. This is a speculative security and, as such, involves a high degree of risk. Investments are not bank guaranteed, not FDIC insured and may lose value or total value. Some investments may have been made in an investment vehicle that is no longer open for investment. The highlighted investment may or may not have been profitable. There is no guarantee that future investments will be similar.

Want to learn more? Contact Us.