Borrower Overview

TriLinc has provided financing to a hospitality service provider engaged in the design, development, operation, and management of hotel properties located in the Cabo Verde archipelago. The company has operated in Cabo Verde since 2007 and has grown into one of the most recognized hospitality property developers in the country. The company runs its operations through three segments including development and sales, day-to-day hospitality, and commercial resort business activity. The tourism industry is a powerful driver of economic development as it creates jobs and stimulates investment in infrastructure and growth in local industries, including agriculture, aquaculture, textiles, and retail consumption. TriLinc’s financing will go towards capital expenditure for the completion of two new resorts on Island Boa Vista. The company is one of the single largest employers in the country and, as a part of its new hotel developments, the company expects to create up to 1,000 new jobs among the local labor force. In addition to its job creation impact, the company has a further developmental impact through capacity building, namely employee training and skills transfer in areas that include health and safety, first aid, hospitality/customer relations, English language, and general management practices.

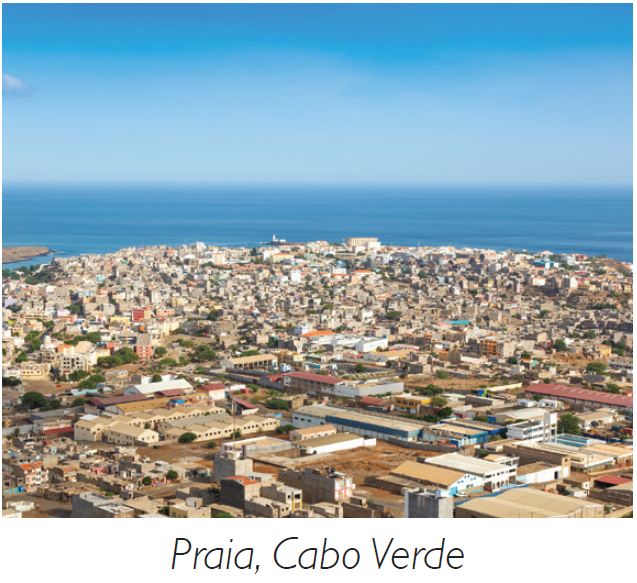

Market Overview

Cabo Verde is classified as a lower-middle-income country by the World Bank.1 Between 2011 and 2015, annual GDP growth rates averaged approximately 1.9%.1 Cabo Verde’s travel and tourism industry represents approximately 38% of total employment in the country, contributing to approximately 43% of the country’s GDP.2 Cabo Verde’s main exports are fuel (re-exports), shoes, garments, fish, and hides.3 Conversely, the country’s main imports are focused in foodstuffs, industrial products, transport equipment, fuels.3

Cabo Verde meets TriLinc’s country standards for its performance across relevant access and stability metrics, and meets some growth metrics.4 In 2016, it ranked 13th across the Sub-Saharan African region on the World Bank’s Ease of Doing Business index.5 With a GDP of $1.6 billion, the country’s growing tourism industry has led the country to benefit from the estimated $42 billion in foreign direct investment that flowed to the region in 2015.6 Sub-Saharan Africa had regional GDP growth of 3.0% in 2015, and is projected to strengthen to 4.4% by 2018.7

Additional Sustainability & Impact Highlights

- The company sponsors general managers employed at its facilities to enroll in online management courses offered by a U.S. Ivy League university.

- As part of a broader reforestation project, the company has planted approximately 2,500 trees on eight hectares around its processing and manufacturing facility, and uses the treated wastewater for watering, care, and maintenance.

- Consistent with its focus on promoting economic development through strengthening community services and programs, the company created a foundation in 2012. The work of the foundation is focused primarily on improving the quality of life for local youth through educational and good health initiatives, including the construction of new school buildings and provision of school kitchen equipment and supplies.

- The company was awarded Gold Standard under the Travelife Sustainability award scheme that demonstrates their active role in managing environmental and social issues.

1The World Bank, World Development Indicators Database: Cabo Verde, 2016. 2World Travel & Tourism Council. Economic Impact 2016: Cabo Verde. March 2016. 3CIA World Factbook, Cabo Verde, 2016. 4There is no assurance that our investment in this company or this market will be successful. 5The World Bank, Doing Business 2017, Measuring Business Regulations, 2016. 6The World Bank, Data, Sub-Saharan Africa, 2016. 7The World Bank, Global Economic Prospects, June 2016.

The above information is as of the initial date of investment: May 27, 2016.

An investment with TriLinc carries significant fees and charges that will have an impact on investment returns. Information regarding the terms of the investment is available by contacting TriLinc. This is a speculative security and, as such, involves a high degree of risk. Investments are not bank guaranteed, not FDIC insured and may lose value or total value. Some investments may have been made in an investment vehicle that is no longer open for investment. The highlighted investment may or may not have been profitable. There is no guarantee that future investments will be similar.

Want to learn more? Contact Us.